Table of Contents

- Key Takeaways

- Why Timing Matters

- Definitions at a Glance

- Post-Purchase Surveys: Your Quick Pulse on Checkout and Attribution

- Post-Fulfillment Surveys: The Reality Check on Delivery and Product

- Choosing the Right Moment: A Quick Decision Matrix

- Survey Design Tips for Each Stage

- Turning Responses into Action

- Common Pitfalls & How to Dodge Them

- Wrapping It All Up

That “Order Confirmed” ping? It’s a gold-mine moment – fresh excitement, open wallet, crystal-clear memory of the checkout flow. A few weeks later, when the package hits the doorstep, the mood shifts to judgment: Was it on time? Intact? Worth it?

Post-purchase and post-fulfillment surveys tap into those two completely different headspaces. One measures the thrill of buying, the other the truth of delivery and product facing. In the pages ahead, we’ll break down what each survey reveals, when to send it, and how to stitch the answers together so you trim ad spend, squash friction, and turn first-time buyers into long-term fans.

Key Takeaways

Most brands pick either a quick pulse survey right after checkout or an NPS after delivery, missing that the two capture totally different insights. Our advice: use both. Run a fast thank-you-page pulse (linked to attribution) to learn why they bought, then send a post-delivery NPS by email/SMS to see how it performed – two surveys, one complete view.

- Timing = context. Ask right after checkout for buying-journey insight; ask after delivery for a reality check on shipping, packaging, and first-use delight.

- Post-purchase wins at attribution. A single “How did you hear about us?” question pinpoints the channel that actually closed the sale and trims wasted ad spend.

- Post-fulfillment guards the promise. Delivery-day questions surface late shipments, damage, or product fit issues before they become public complaints and can feed happy customers straight into review requests.

- Two touches beat one. Running both surveys doubles retention-prediction accuracy, links NPS swings to ARR, and paints a full picture of the customer journey.

- Close the loop. Route answers to the right teams, act fast, and broadcast “You said / We fixed” updates. It builds trust and keeps response rates healthy.

Why Timing Matters

Think back to the last big purchase you made. What sticks in your mind? Probably the one moment that spiked your emotions – good or bad – and the very last thing that happened. Psychologists call this the peak-end rule: we judge an experience by its highest (or lowest) point and by how it finishes.

Surveys obey the same gravity:

- Right after checkout, emotions run high, details are fresh, and response rates hit their max.

- Hours later, enthusiasm fades. Each passing minute chips away at both memory and motivation.

- Post-delivery, a brand-new swell of feeling arrives: delight if the package is flawless, frustration if it’s late or dented.

Definitions at a Glance

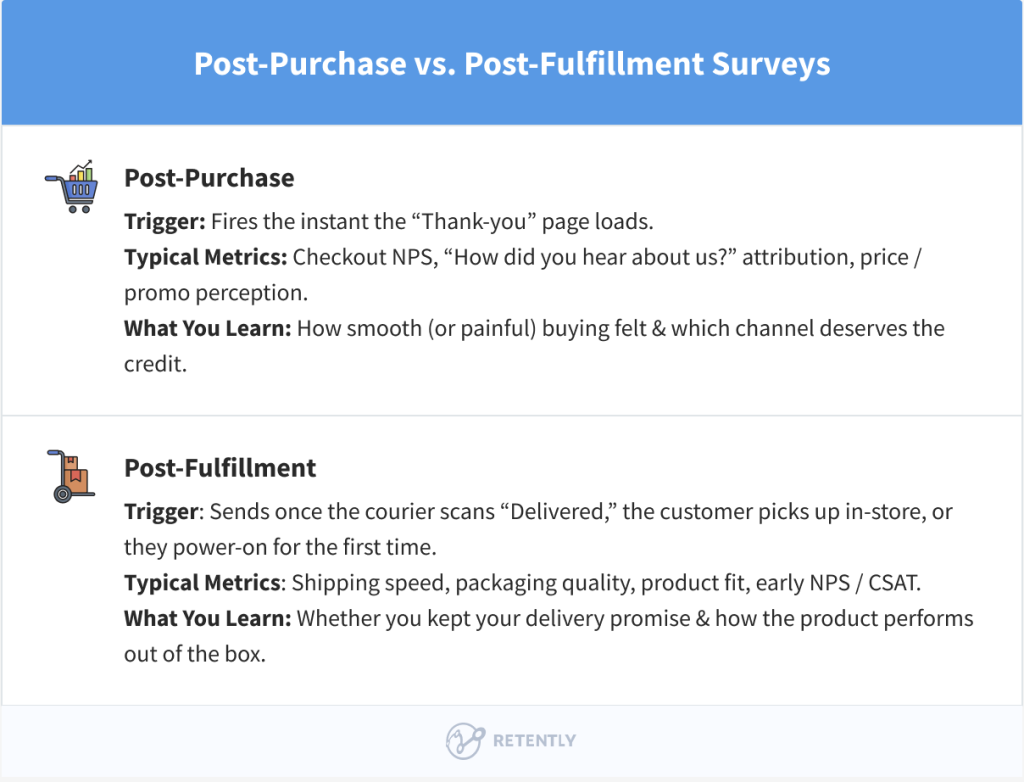

Post-Purchase Survey

This one drops the moment the “Thank-you” page loads or the confirmation email lands. It measures the buying experience – things like checkout effort, promo-code clarity, and that all-important “Where did you hear about us?” channel question. In short, it tells you which marketing dollars worked and whether the cart flow felt painless.

Post-Fulfillment Survey

Triggered as soon as the courier scans “Delivered,” the customer picks up curbside, or they power on a new gadget. Here you ask about shipping speed, packaging, and early product satisfaction (NPS or CSAT). It’s the reality check: did you meet the promise and does the product wow out of the box?

Two surveys, two very different headspaces, both relevant if you’re chasing higher repeat rates and smarter ad spend.

In the sections ahead, we’ll break down how to build each one without annoying your customers or flooding them with questions.

Post-Purchase Surveys: Your Quick Pulse on Checkout and Attribution

Right after a customer clicks “Place Order,” they’re still riding the adrenaline of the buy. That’s the perfect window to squeeze in a post-purchase survey, one or two micro-questions that do double duty:

First, it probes the checkout experience. Was the cart easy to navigate? Did the promo code work the first time? Any hiccups with payment? Fresh memories mean precise answers, and you’ll spot friction long before it shows up as abandoned carts.

Second, locks in true attribution. Slip in a friendly “How did you first hear about us?” and you get straight-from-the-source data on whether that Insta reel, Google Ad, or affiliate link actually closed the deal. Feed those answers into your ROAS dashboard and decide which channels deserve the next budget bump.

Timing is everything, so keep the trigger immediate: a slide-up on the thank-you page, a one-click poll in the confirmation email, or even a quick “Reply 1-5” SMS for mobile-heavy audiences. The questions themselves should be laser-focused and few – think checkout ease, discount clarity, and discovery source – so you grab a high response rate without feeling intrusive.

Reply rates are high because the shopper is still engaged, and you get instant validation of ad spend plus a heat map of checkout pain points. Yet, you’ll learn nothing about shipping speed, packaging, or first-use satisfaction – that’s the post-fulfillment survey’s turf, and we’ll get to that shortly. So run this pulse for buying insights, then follow up later to learn whether you delivered on your promises.

Post-Fulfillment Surveys: The Reality Check on Delivery and Product

Fast-forward a few days: the courier scans “Delivered,” the curbside runner drops the parcel in your customer’s trunk, or that satisfying click registers as the box’s NFC tag is peeled open.

Right then, the excitement of buying is replaced by a new question: Did the product show up when, how, and in the condition I expected? That’s the cue for a post-fulfillment survey.

The moment the package hits the doorstep, expectations meet reality. A post-fulfillment survey taps that fresh emotion – whether it’s “Wow, that was fast!” or “Why is this box crushed?” – and turns it into action-ready data.

Because it fires off a carrier webhook or “first-open” trigger, it captures emotions while the packaging tape is still on the coffee table. Keep the ask simple:

- “Did your order arrive on time?”

- “On a scale of 1-5, how was the unboxing experience?”

- “Based on what you’ve seen so far, would you order again?”

These questions pin your promise to the outcome. If the shipment was late or the box dented, you’ll know before the customer vents on social. Better yet, happy responses can flow straight into review requests, turning fresh delight into public proof.

Of course, there’s a trade-off. Wait more than 48-72 hours and enthusiasm fades, dragging response rates with it. And because this survey focuses on delivery and product use, it can’t tell you which ad or influencer drove the sale in the first place. That’s okay. Pair it with your post-purchase pulse and you’ll cover both sides of the story: the thrill of the buy and the reality of delivery.

Up next, we’ll lay out a playbook for stitching both pulses into one seamless customer-feedback loop.

Choosing the Right Moment: A Quick Decision Matrix

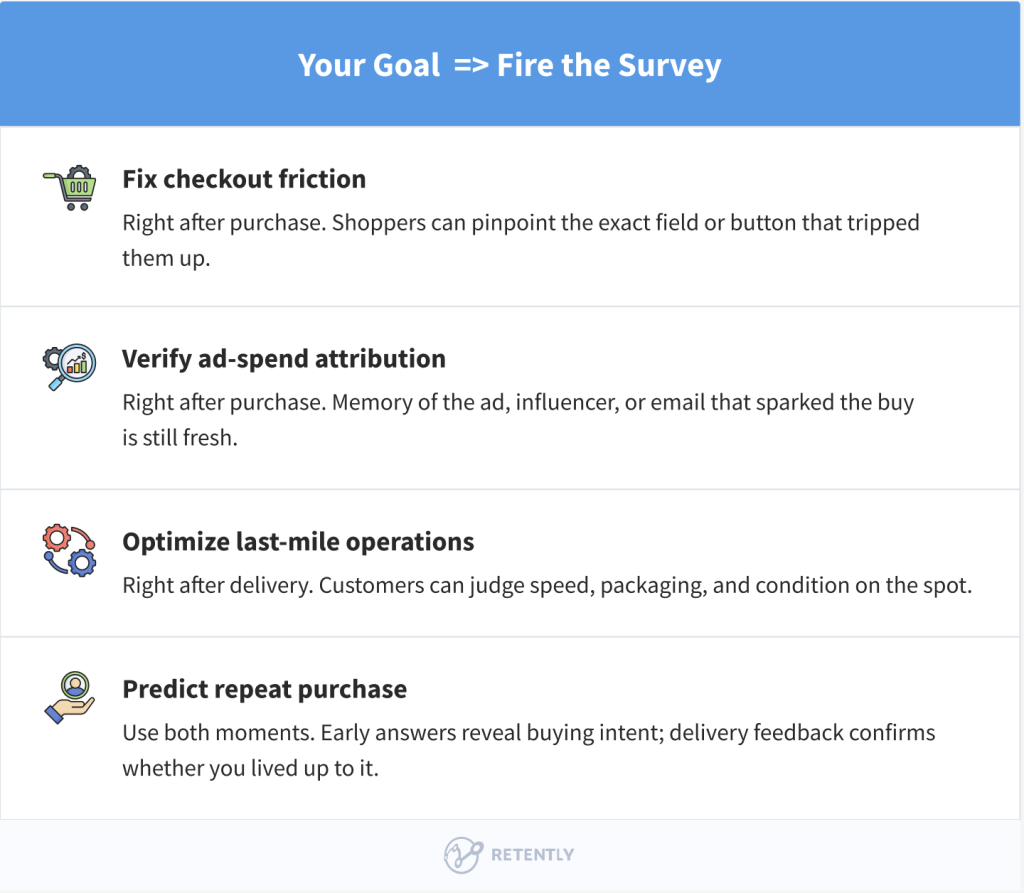

Every survey has a job to do. Match the job to the moment and you’ll grab clear-headed, action-ready insights instead of half-baked opinions.

Start by clarifying what you actually need from the survey. If your priority is to iron out checkout glitches, the post-purchase pulse is the clear winner; customers can still name the exact field or promo code that tripped them up. The same “ask-immediately” rule applies when you want to trace ad spend – only a fresh memory will tell you whether that Instagram reel or Google ad truly sealed the deal.

On the other hand, if your goal is to tighten last-mile operations, wait until the package lands. A post-fulfillment survey captures shipping speed, box condition and first-use impression, none of which show up right after checkout.

Finally, when you’re trying to predict repeat purchase, you’ll need the full picture: use an early pulse to gauge intent, then follow up after delivery to confirm you lived up to the promise. Together, the two timestamps give you the clearest signal on whether that first-time buyer is on the road to becoming a loyal fan.

Keep this grid handy: one glance tells you which survey to send, when, and why. Up next, we’ll look at designing the questions so each moment delivers maximum signal with minimum hassle.

Survey Design Tips for Each Stage

A well-timed survey still falls flat if the delivery channel, tone, or length feels off. Use these quick guardrails to keep response rates high and fatigue low.

1. Choose the channel they’re already using

For the post-purchase pulse, keep the survey exactly where the buyer just clicked “Pay.” A two-click slide-up on the thank-you page, a single-question snippet in the confirmation email, or a tap-back SMS all work because the shopper is still engaged. Post-fulfillment is different: the action has shifted to their inbox or phone notifications, so an email triggered by the courier’s “Delivered” webhook (or a gentle push notification inside your app) is the most natural fit.

2. Match the question count to attention span

Right after purchase, the buyer’s priority is moving on with their day, so stick to one to three micro-questions. It’s enough to spot a cart hiccup or capture attribution, but not enough to feel like homework. Once the package arrives, you have permission to ask a bit more: up to five concise questions about delivery speed, packaging quality, and first-use satisfaction. Any longer and completion rates nosedive.

3. Shift the tone with the moment

The post-purchase tone should be upbeat and congratulatory: “Thanks for your order. Mind if we ask one quick thing?” After fulfillment, switch to a service-oriented voice: “Your package just landed. How did we do?” That subtle pivot signals you understand where the customer is in the journey and respect their time.

4. Personalize just enough to build trust

A sprinkle of specifics – order ID, product name, or color – reminds shoppers you’re talking about their exact purchase, not blasting a generic form. In post-fulfillment messages, reference the promised delivery date or ETA: “We aimed for March 3rd – did we hit it?” Personal touches boost credibility and jog memory, which translates to better data.

Dialing in these four elements keeps response rates healthy and feedback actionable, no matter which survey moment you choose.

| Design Element | Post-Purchase Sweet Spot | Post-Fulfillment Sweet Spot |

|---|---|---|

| Channel mix | Email pop-in, thank-you page, or SMS tap-back. Keep it where the buyer already is. | Email, SMS, or in-app push. Triggered by the carrier’s “Delivered” ping or a first-use event. |

| Question count | 1-3 short questions. Buyers are eager to move on; respect their momentum. | Up to 5 short questions. Shoppers now have more context to share, so dig a little deeper. |

| Tone shift | Celebratory & grateful. “Thanks for your order! One quick question…” | Reflective & service-oriented. “How did everything go? Your feedback helps us improve.” |

| Personalization hooks | Use the order ID and product name. Shows you know what they bought and adds trust. | Mention ETA or delivery date. Reinforces timeliness and jogs memory about shipping expectations. |

Tip: If you’re running both surveys, change the look just enough – different header color or icon – so customers immediately recognize that they’re being asked about a new stage, not the same thing twice.

Turning Responses into Action

A survey that dies in a spreadsheet is just busywork, so build an automatic runway for every answer that comes in. Start with attribution data from your post-purchase pulse. When a shopper says, “I found you on Instagram”, that response should flow straight into the same ROAS dashboard that tracks click-throughs and spend. Suddenly, you’re not guessing which ad closed the deal, you’re staring at first-party proof.

Next, give every UX complaint a direct lane to the people who can fix it. A buyer who marks “Checkout was confusing” at 9:07 a.m. should have their comment sitting in a product owner’s Slack channel by 9:10. That speed turns anonymous frustration into a documented ticket while the context is still fresh.

Delivery feedback follows a different highway. If a post-fulfillment survey flags a late shipment or damaged box, punch that alert into your CX queue with a bright “PROACTIVE CREDIT?” tag. Issuing a small voucher before the customer even reaches out flips a potential rant into a loyalty moment.

Finally, don’t let the scores live in isolation. Pipe NPS or CSAT from both surveys into the same model you use for customer lifetime value and churn prediction. A shopper who praises checkout but slams delivery needs a different save tactic than one who’s happy end-to-end. When feedback, revenue, and retention data share a single spreadsheet, or better, a live data warehouse, you’re no longer running surveys; you’re running a closed-loop growth engine.

Common Pitfalls & How to Dodge Them

Nail these three basics and your timing strategy won’t get tripped up by mechanics, tech lag, or small screens, leaving you free to focus on the insights that actually move the needle.

1. Asking the same question twice

Nothing tanks response rates faster than déjà-vu. If you already asked “How did you hear about us?” on the thank-you page, don’t recycle it after delivery. Map out both surveys on one sheet, circle any overlaps, and trim ruthlessly. Each touch-point should feel new, not nagging.

2. Webhook lag that fires surveys at the wrong time

Carriers sometimes post “Delivered” hours late (or early). If your post-fulfillment email lands before the box does, you’ll collect angry “It’s not here yet!” replies. Fix it by adding a short buffer – say, two hours – and by cross-checking the courier status with the customer’s local time zone before triggering the send.

3. Forgetting the phone-first reality

Over half of survey opens happen on mobile. Long grids, tiny radio buttons, or non-responsive thank-you pop-ups make people bail in seconds. Keep questions single-column, use thumb-friendly buttons, and preview every survey on a mid-range Android as well as an iPhone before you go live.

Wrapping It All Up

Getting feedback isn’t the hard part; getting the right feedback at the right time is. A tiny, well-placed question on the thank-you page tells you why someone bought and which ad deserves the credit. A follow-up ping the moment a package hits the doorstep tells you whether you kept your promise. Together, those two pulses close the loop from click to unboxing, letting you plug ad dollars where they work, fix friction fast, and turn fresh delight into five-star reviews.

Ready to put it into play?

1. Sketch the journey on a whiteboard, then circle the single moment that best answers today’s burning question. Want to trim wasted ad spend? Circle checkout. Worried about dented boxes and late couriers? Circle delivery.

So, you need to decide which KPI you need first:

- Attribution ➜ ask right after checkout.

- UX friction ➜ same early window, different questions.

- Delivery quality ➜ wait for the courier’s “Delivered” scan.

2. Drop two tracks for each survey moment.

- Post-purchase: spin one survey at zero minutes and another at the 24-hour mark.

- Post-fulfillment: try “Doorstep Drop” (instant) versus “First Use” (48 hours).

See which mix gets the higher opens, richer comments, and fewer skips.

3. Every month, post a simple graphic: “You said ➜ We fixed.” Moved the promo code box? Swapped carriers? Show it off. Customers lean in when they know their words turn into action and they’re far more likely to keep talking.

Prefer one engine that does both and more? Go flexible with Retently. Trigger a survey at checkout, wait until the first “Delivered” webhook, then fire the second set of questions. With one system powering email, link and in-app prompts, you keep data in a single warehouse and skip the headache of stitching exports together. This way, you’ll have a lean, two-touch feedback engine that keeps ad spend honest, operations sharp, and customers coming back for more.

Christina Sol

Christina Sol

Greg Raileanu

Greg Raileanu