Table of Contents

- Key Takeaways

- 1. Understand the Net Promoter Score Analysis

- 2. Take a Closer Look at Your NPS Distribution

- 3. Find Which Survey Channels Work Best

- 4. Focus on Customer Engagement

- 5. Feedback Sentiment Analysis

- 6. Feedback Text Analysis

- 7. Take Feedback Analysis Seriously and Act on It

- 8. Monitor Customer Satisfaction at Each Customer Journey Point

- 9. See What Engagement Metrics Define Your Customers

- 10. Segment NPS Data by Customer Demographics

- 11. Track NPS Trends Over Time

- 12. Benchmark Against Industry Standards

- Retently – NPS Analysis Made Easy

Net Promoter Score® (NPS®) usually correlates with a business’ growth potential – and for good reason. However, it’s important to understand that there’s more to an NPS campaign than the score itself. Various aspects of the NPS data will help you collect in-depth customer insights, which are usually easy to miss but, nevertheless, crucial for an effective NPS campaign.

The only issue is that interpreting the data can be challenging – especially if you’ve never done it before.

Don’t worry, though – we’ve got you covered with useful tips on how to analyze the survey data from your NPS campaigns. So, let’s get to it.

Key Takeaways

- Effective NPS campaigns depend on analyzing different data points to capture valuable customer insights.

- Identifying the best survey channels and key engagement metrics improves response rates and feedback quality.

- Sentiment and text analysis tools efficiently process large volumes of feedback, identify pain points and provide actionable insights.

- Monitoring and benchmarking NPS trends against industry standards helps spot shifts in customer sentiment and maintain a competitive edge.

1. Understand the Net Promoter Score Analysis

We already have a comprehensive article on what is considered a good NPS score. Overall, here are the main things you should keep in mind:

- If your score is below 0, there’s a reason to be concerned since it means that you have a higher number of dissatisfied customers (Detractors) than happy ones (Promoters);

- If your score is anywhere between 0 and 30, it says you’re doing quite well, but that there might be room for improvement;

- If your score is between 30 and 70, that denotes your business is doing great in terms of customer satisfaction;

- If your score is higher than 70, congratulations! Most of your clients are brand advocates.

Just keep in mind – the score itself is quite volatile and can vary a lot depending on how many clients you have, and how many of them actually respond to the survey.

2. Take a Closer Look at Your NPS Distribution

Basically, we’re referring to the total distribution of Promoters, Passives, and Detractors. This comes in handy if you have multiple business locations to keep track of.

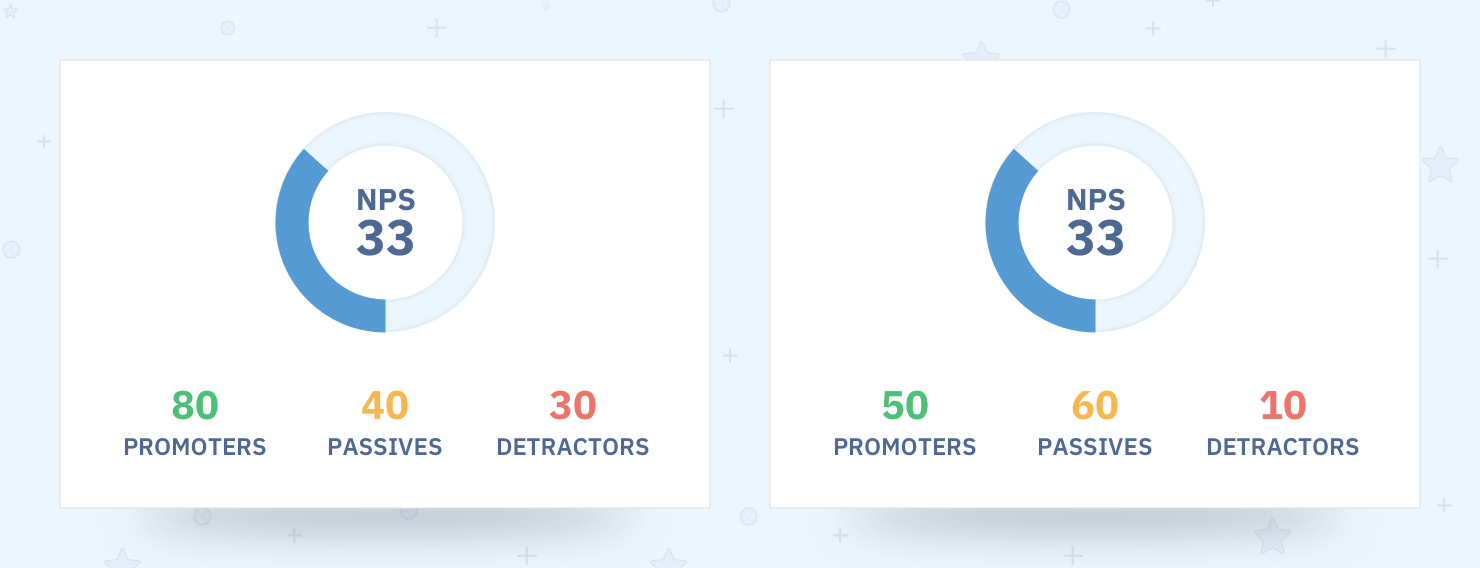

For instance, say you have 2 stores with the exact same NPS score of 33. That info alone is not enough to make a clear decision on how you would work the customer experience in the future.

Why? Because there’s always a chance that store A has a larger number of Promoters than store B, while store B has a more significant number of Passives and fewer Detractors than store A.

Considering this, you will need a different approach for each store.

When it comes to client distribution, especially in B2B, a different approach would be to consider the role of those responding to your surveys. For example, you could find out that your product is quite popular with middle management while executives don’t interact with it. Make sure you are surveying the right people and get the maximum out of your voice of the customer program.

3. Find Which Survey Channels Work Best

NPS campaigns are generally carried out through the following channels:

- Link embed

- In-app (web pop-up)

- Text messages (SMS)

- Messengers

- Phone calls

All channels have specific pros and cons. However, if you are a small business on a tight budget, you can’t really afford to focus on all of them to see which one is the most appropriate for your audience.

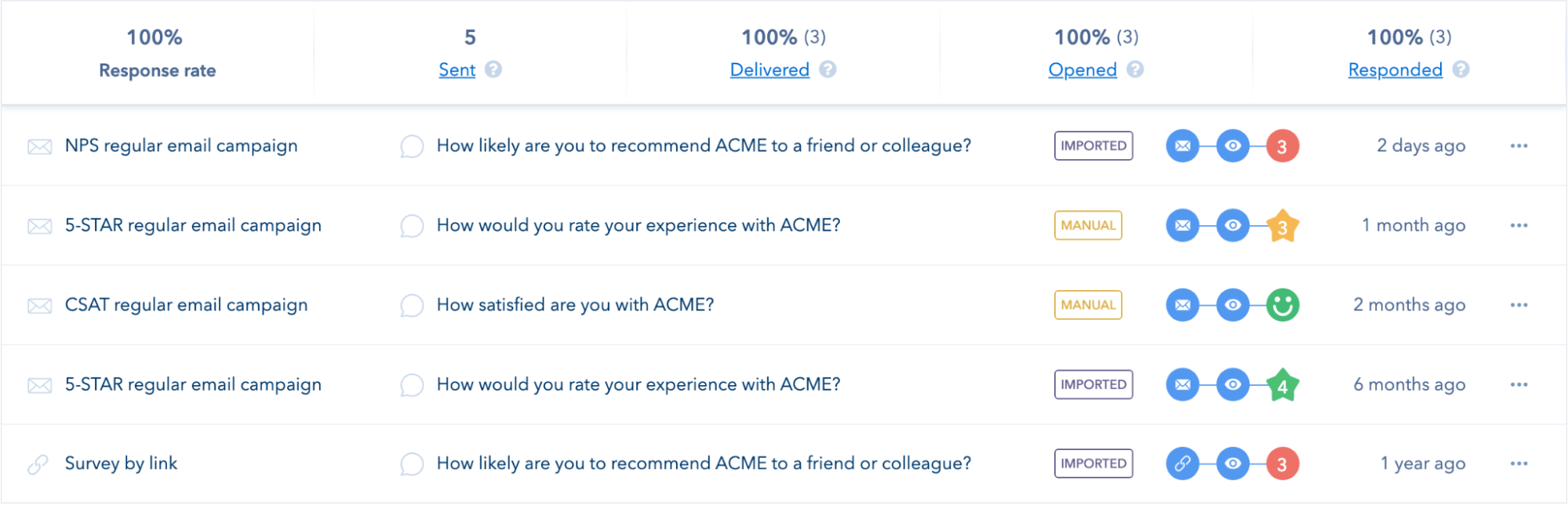

Luckily, a thorough NPS survey analysis can showcase which channels work best with certain types of clients. Let’s face it – depending on a customer’s position in a company, age, or standing in life, they would be more likely to interact with a channel that resonates with their lifestyle.

This type of segmentation can be very useful, as NPS surveys can be automated to ensure they are sent to clients only through relevant communication means, thus significantly increasing response rates.

Some NPS products will display the preferred survey channels for a particular customer segment. Advanced services, though, will allow you to set a preferred channel for a customer, or audience segment, and give that channel a higher priority when sending surveys automatically.

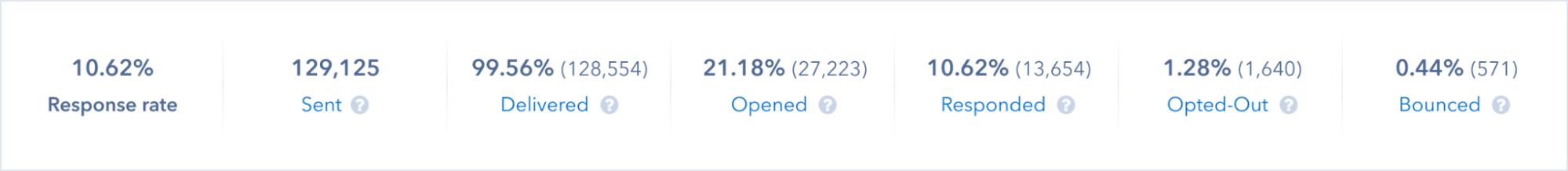

Survey delivery reports provide great insight into this matter. The most important metrics to consider are the survey response and survey score rates.

4. Focus on Customer Engagement

Essentially, you need to find out which clients engage with your NPS surveys the most – who is more likely to answer your question(s) and leave feedback, and how often they do it. This way, you can identify the exact customers who are more likely to offer actionable feedback. Your Customer Success team can reach out and do their best to convert these customers into brand advocates.

Basically, you need to check your survey delivery stats per customer and find their response rate. Target customers with the highest response rate since they are most engaged with your surveys. But this goes the other way around as well. It is also highly recommended to identify clients with a low response rate and try to understand what’s stopping them from engaging with your NPS survey.

If you survey customers on multiple channels, such as email and in-app (web), you might want to consider checking the survey delivery stats for individual customers. Find out which are the most answered surveys by a specific client, or on the contrary – which have been ignored. This will help you understand the customer’s preferred survey channel. Make sure you continue communication on channels they are most comfortable with.

Also, don’t forget to cross-check the NPS survey results with other important business intelligence data you have, such as how clients engage with your product(s) or marketing campaigns. Something as simple as that can help you acquire new insights into improving your product or service (or if you need to improve at all), and how you can adjust your marketing messages and branding to better resonate with your target audience.

5. Feedback Sentiment Analysis

If you’re not very familiar with customer sentiment analysis, think of it as an information processing method that can be used to determine customer opinions based on the sentiment (positive, negative, neutral) associated with their comments. This method can help you learn whether or not clients were happy with a new product/service/feature, find quick solutions to customer issues, and even understand emerging trends.

You can gain proper sentiment analysis from survey responses (which is why we recommend doing it when analyzing NPS survey data), customer reviews, and social media interactions.

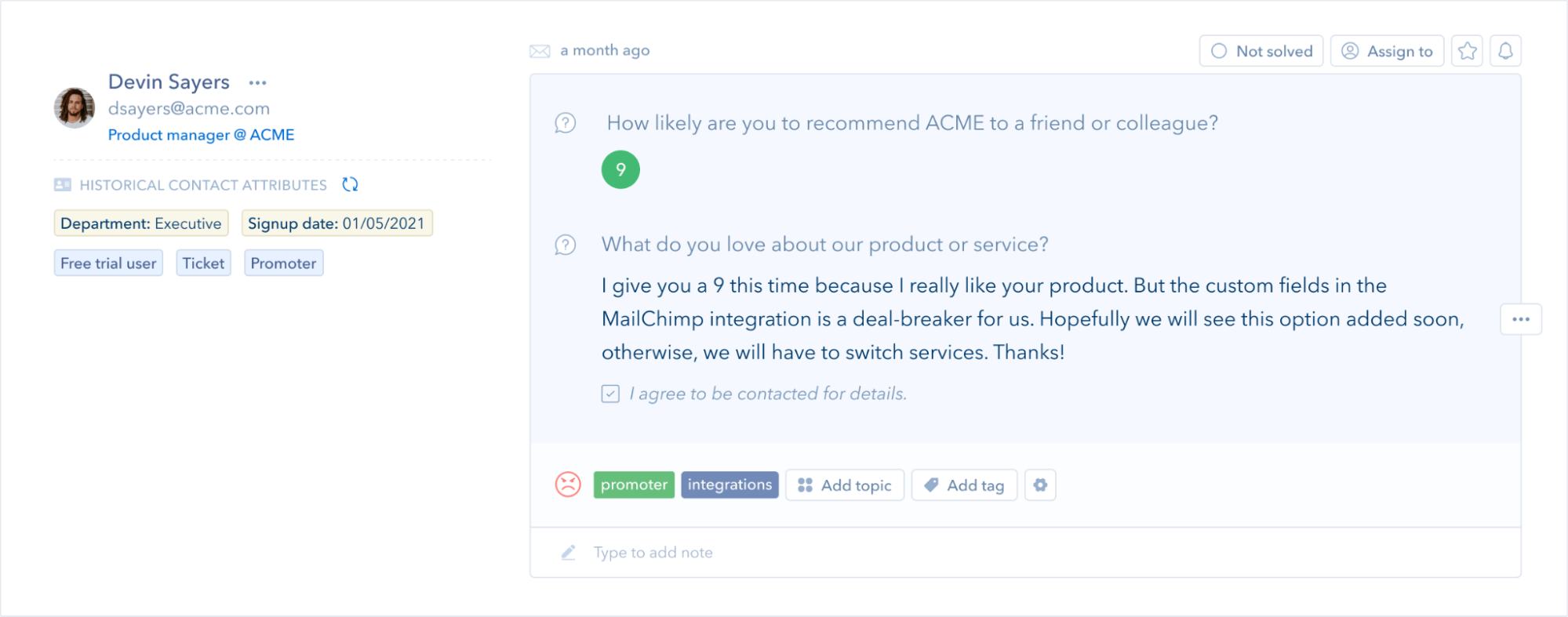

Analyzing response sentiment is a good way to identify potential issues or biased NPS data. It will also help you prioritize feedback since a Promoter with negative feedback deserves your immediate attention. If you act in a timely manner, you can avoid losing a potential long-term customer.

6. Feedback Text Analysis

There is nothing more powerful than seeing your brand through the eyes of your customers. However, if you receive thousands of NPS responses, sorting through the received feedback becomes challenging. There’s simply too much feedback to analyze manually, no consistent criteria to rely on, and a lack of granularity involved.

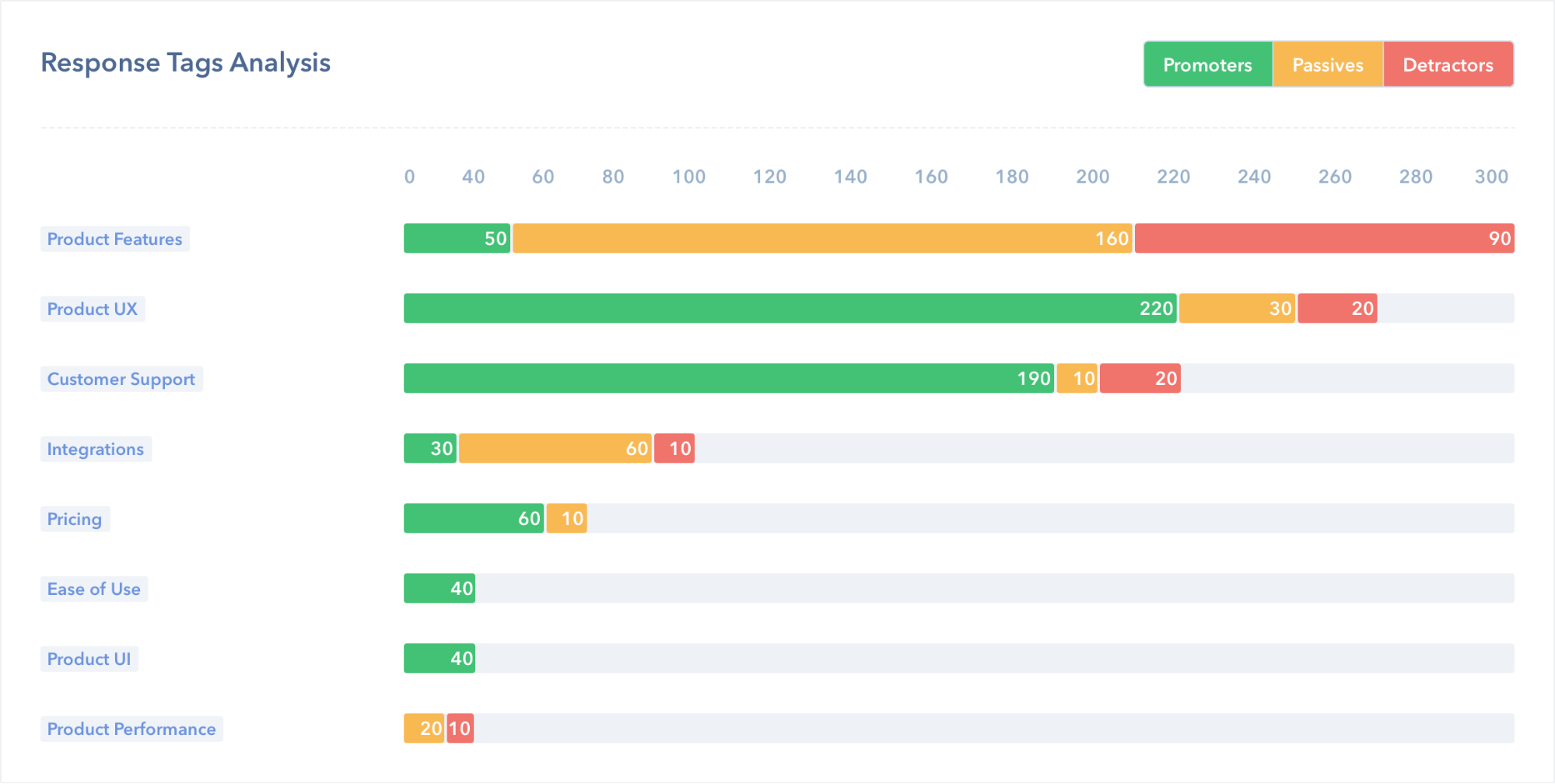

Fortunately, several automated text analysis solutions, like MonkeyLearn or Thematic, enable you to automatically process high volumes of NPS responses and ensure consistent tagging criteria around the clock.

Text analytics applied to NPS responses can help identify common customer pain points by grouping feedback into theme buckets (tags), allowing you to understand how to improve. You would be able to group the Promoters, Passives, and Detractors, and find the most prevalent tags in their responses.

The variety of data received following this survey text analysis is an incredible opportunity to take action and convert weaknesses into strengths.

AI is a game-changer for these text analysis solutions. It uses advanced algorithms to quickly and accurately sift through vast amounts of data. These tools can grasp context, catch subtle nuances in language, and get smarter over time. This means you gain deeper insights from your NPS feedback, helping you zero in on specific areas that need improvement and better understand what your customers really want. It makes the whole analysis process smoother and ensures your feedback system can grow with your business, handling more and more data as you expand.

7. Take Feedback Analysis Seriously and Act on It

Businesses keen on building long-lasting customer relationships increasingly turn to customer satisfaction surveys to measure and improve their customer experience. NPS surveys can help you gain plenty of valuable insights into how customers really feel about your brand.

However, solely gathering customer responses is not sufficient; understanding and responding to the collected feedback is crucial. Once the weak processes are identified, businesses must close the loop with an immediate response to ensure the unpleasant situation is traded for a positive experience.

Also, you should share all information acquired during the NPS data analysis across relevant departments in your company. Ideally, everyone – from people involved in product development and customer support to those handling your marketing campaigns – should know what exactly your clients think about your services and/or products .

Some NPS services give you the option to involve your colleagues directly in the NPS process by giving them access to your campaigns. You can turn customer feedback into assignments or follow-up reminders for your colleagues and track progress without having to leave the platform.

8. Monitor Customer Satisfaction at Each Customer Journey Point

You already know that NPS can provide accurate data regarding customer satisfaction, but did you know you can segment it up to a specific customer lifecycle stage?

Essentially, we’re talking about gauging the average level of satisfaction among your customers up until a particular point, and then using that info to better tailor and personalize your future customer satisfaction campaigns.

Once you have enough customer data, you can start setting up campaigns for each stage and even automate the process to a certain extent. You should also use this type of information to customize your survey template better. Personalize the NPS rating and open-ended questions so that they resonate with each stage.

For example, once you better understand your Passives, you could set an NPS survey to trigger whenever a specific event occurs. Send an NPS survey at each stage of a customer’s lifecycle to see how satisfied they are with using your product, learn how you can improve their experience, and what are the stages with the highest churn risk.

Consider Amazon, which successfully tracks customer satisfaction at every step of the customer journey using segmented NPS data. They use automated NPS surveys triggered by key events like purchases and deliveries, allowing them to gather timely feedback and quickly address any issues. This approach has helped Amazon rank first in the American Customer Satisfaction Index (ACSI) for value, selection, and online shopping experience.

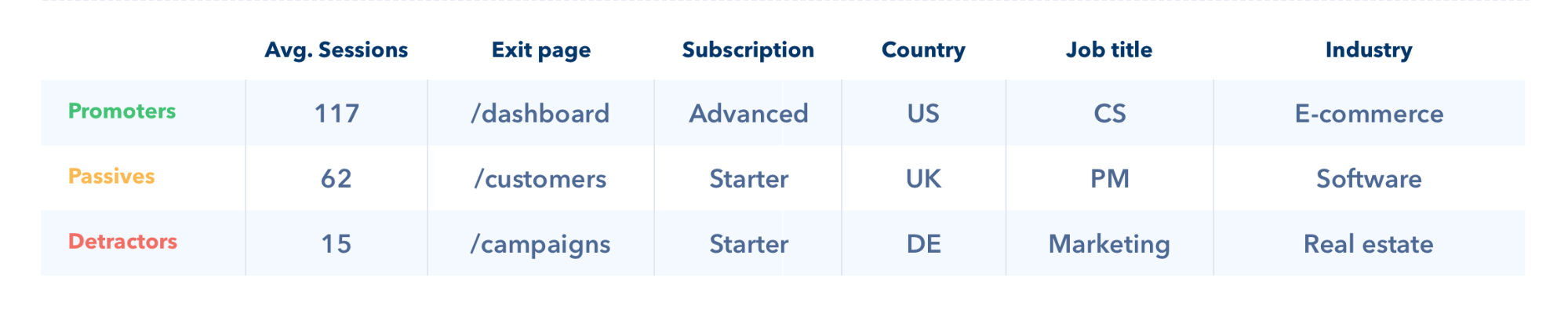

9. See What Engagement Metrics Define Your Customers

Correlate your Promoters, Passives, and Detractors with engagement metrics that showcase:

- The number of logged sessions

- The most visited pages

- The average sessions

- The click-through rate

Just imagine it – if you knew which of your web pages your Promoters visit the most, you could place actionable CTAs to drive even more engagement from them. The same logic could be applied to Detractors or Passives. You could send them a well-timed pop-up message offering a discount or a sneak peek of an upcoming feature.

Also, finding out what most of your Detractors and/or Passives have in common in terms of online behavior could help you reduce customer churn by taking the appropriate measures, too.

Importing your customers’ data into your NPS service will help you identify patterns in how Detractors, Promoters, or Passives use your product. This will help you spot unhappy customers before they churn, allowing you to get in touch with them and learn how you can improve their experience.

10. Segment NPS Data by Customer Demographics

To get the most out of your NPS analysis, try segmenting your data by customer demographics like age, gender, location, or background. This approach can provide more detailed insights into how different groups of customers feel about your products or services.

By understanding which demographics are more satisfied or dissatisfied, you can tailor your strategies to meet each group’s unique preferences. For example, younger customers might prioritize tech features more than older customers do.

Collect demographic information as part of your NPS surveys. Then, analyze the NPS scores across these different demographic segments to spot emerging trends and better cater to the diverse customer needs.

11. Track NPS Trends Over Time

Keeping an eye on NPS trends is important for understanding shifts in customer sentiment and spotting long-term patterns. This ongoing analysis helps businesses anticipate customer behavior and identify underlying issues or successful initiatives.

For instance, if you notice a gradual drop in NPS, it could indicate declining product quality or service inefficiencies, which need immediate attention. A consistent increase in NPS might show that your recent improvements, like new features or better customer support, are hitting the mark.

To effectively track these trends, businesses should:

- Schedule regular check-ins to review NPS data systematically.

- Connect NPS changes to significant company actions or external events in order to pinpoint cause-and-effect relationships.

- Use graphs and charts to clearly visualize NPS trends and patterns over time.

- Adjust business strategies based on the captured insights to further improve customer satisfaction.

12. Benchmark Against Industry Standards

To add more context to your NPS, benchmark it against industry standards. By comparing your NPS to industry norms, you can see how your customer satisfaction stacks up against your competitors.

- Below Industry Average: If your NPS is below the industry average, it might indicate that competitors are providing a better customer experience. This calls for a deep dive into your service offerings and customer feedback to identify and address any gaps.

- Above Industry Average: An NPS that exceeds industry benchmarks validates your current strategies and underscores your competitive edge.

Regularly comparing your NPS to industry standards helps you set realistic performance goals and leverage industry data to guide improvements or sustain your leadership.

Retently – NPS Analysis Made Easy

Businesses constantly deal with data; however, raw data is only insightful if neatly organized.

The challenge is to figure out how the collected information can address existing issues and make the business visible.

All the survey analysis data we discussed up until now can offer you many insights into how your customers think. Still, there’s just one problem: getting access to all of that info at a time can be quite hard – unless you use a specialized NPS service like Retently, that is.

With Retently, you can easily run NPS campaigns through multiple channels, customize the templates to make them more engaging, and get all the post-campaign data you need – all in one place.

Alex Bitca

Alex Bitca

Greg Raileanu

Greg Raileanu

Christina Sol

Christina Sol