Let’s be honest: ecommerce CX advice is everywhere, and most of it sounds the same. “Remove friction.” “Delight the customer.” “Be customer-centric.” None of that is wrong… but none of it is specific enough to help you decide what actually deserves attention when budgets, teams, and patience are limited.

That’s the problem with opinion-led CX. It’s shaped by loud success stories, or whatever framework is trending on LinkedIn that month. Meanwhile, customers are quietly voting with their wallets and feedback in ways that don’t always match what brands think matters.

This study by Retently flips that lens entirely. Instead of asking what should matter, we looked at what customers consistently reward and what they punish across real ecommerce journeys. The goal is not to propose another best-practice framework, but to surface the few experience dimensions that repeatedly shape loyalty, trust, and disengagement at scale.

When you zoom out, CX stops being a matter of taste. Clear pillars emerge again and again, not because a model said so, but because customers kept talking about the same things. Those six pillars are:

- Product & quality: what arrives and whether it lives up to the promise.

- Pricing & value: not just how much it costs, but whether it feels justified.

- Shopping experience: clarity, ease, and friction across the site and checkout.

- Customer service: how fast, human, and effective help feels when it’s needed.

- Shipping & delivery: where promises are tested and trust is either built or broken.

- Sustainability: increasingly tied to loyalty when it’s credible and consistent.

These aren’t abstract categories. They’re the areas where customers repeatedly decide whether a brand is worth sticking with or quietly walking away from.

When the same patterns repeat at scale, CX stops being subjective. And that’s exactly where ecommerce CX in 2026 is headed: away from guesswork and toward evidence.

Key Takeaways

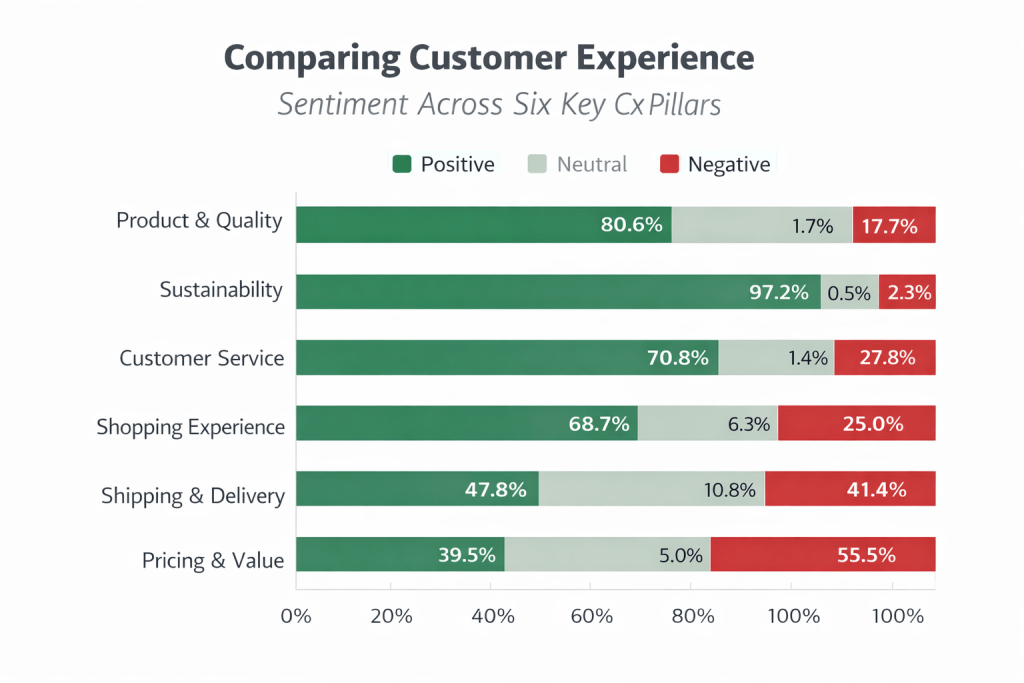

- Product & quality is the strongest and most consistent loyalty driver with 80.6% positive sentiment.

- Sustainability is emerging as a fast-rising reinforcement factor, but it impacts loyalty only when product quality is strong.

- Pricing & value stand out as the primary friction point, registering 55.5% negative sentiment and remaining the only net-negative CX category.

- Shopping experience & customer service perform well when journeys are seamless and support feels fast and human, but primarily act as a loyalty amplifier, not a creator.

- Shipping & delivery emerge as the most volatile pillar, where execution reliably determines whether customers become Promoters or Detractors.

Methodology

This study analyzes large-scale post-purchase and post-interaction customer feedback collected across ecommerce brands between January and December 2025.

The dataset consists of 1,500,000+ NPS, CSAT, and CES responses from a sample of 500 ecommerce companies operating across multiple verticals (including apparel, personal care, food & beverage, home goods, etc.). The feedback reflects real customer experiences, not hypothetical preferences – in other words: patterns, not opinions.

Open-text responses were processed using AI-assisted topic extraction and sentiment classification. Each response was assigned one or more semantic topics and labeled for sentiment polarity (positive, neutral, or negative) based on linguistic and emotional cues.

Over 100 distinct customer topics were identified and grouped into six higher-order CX categories based on functional similarity and recurring customer language. While the relative volume of mentions varies by pillar, the consistency and direction of sentiment patterns within each category is what makes them analytically meaningful.

Percentages reported reflect sentiment distribution within each category, not overall customer satisfaction. Net sentiment represents the balance between positive and negative mentions and is used as a directional indicator of loyalty impact, not as a causal measure of business performance. Because the dataset is based on voluntary post-interaction feedback and automated topic labeling, results reflect expressed perceptions within this sample and are intended for comparative insight, not as universal performance benchmarks.

So, let’s dive in!

Product & Quality: The Strongest Driver of Loyalty

If there’s one result in this study that cuts through all the CX noise, it’s this: product & quality dominate everything else. With 80.6% positive sentiment – the highest score in both volume and consistency – it outperforms UX, delivery speed, customer support, and every other lever brands usually obsess over.

That doesn’t mean those things don’t matter. It means they matter after the product earns trust.

The feedback makes this painfully clear. Customers are surprisingly forgiving when things aren’t perfect. They’ll tolerate a clunky checkout, a slower-than-expected delivery, or even a delayed support response as long as the product delivers on its promise. What they don’t forgive is disappointment.

Customers forgive friction. They do not forgive disappointment.

When customers talked about “product & quality”, they weren’t using abstract language. Their comments consistently clustered around three very concrete expectations:

- Durability: Does the product hold up after real use, not just unboxing?

- Consistency vs. past orders: Is this item as good as the last one, or did quality quietly slip?

- Accuracy vs. product pages: Does what arrived actually match the photos, descriptions, and claims?

This is where many CX strategies quietly break. Brands invest heavily in smoothing the journey – fast checkout, polished emails, sleek tracking pages – while letting product truth drift. That creates what looks like loyalty on the surface, but it’s fragile. The moment the product underdelivers, everything else collapses.

No amount of CX polish compensates for a product that underdelivers.

The data also helps explain something many teams struggle to articulate: speed is not the same as confidence. A fast checkout followed by post-purchase silence creates anxiety, not satisfaction. In contrast, customers repeatedly signaled that they’re willing to accept slower experiences when those experiences feel clear, honest, and under control.

This is where the distinction between actual time and perceived time becomes critical.

- Actual time is how long something truly takes.

- Perceived time is how long it feels like it takes.

The brands that perform best on product-related loyalty actively manage perceived time through:

- Micro-confirmations that reassure customers that things are moving

- Proactive delay framing (“Here’s why this takes longer and why it’s worth it”)

- Expectation shaping baked into the experience, not buried in fine print

In 2026, this kind of expectation management isn’t a nice-to-have, it’s CX infrastructure. Once customers trust the product, they’re far more patient with the process and far less forgiving when that trust is broken.

Sustainability: From “Nice to Have” to Loyalty Multiplier

For a long time, sustainability lived in the “good branding” bucket. Nice messaging, nice values, but rarely something teams treated as a serious CX lever. The data from 2025 tells a very different story.

With 97.2% positive sentiment (despite lower mention volume), sustainability is the fastest-rising category in the entire study. And that matters, not because it suddenly drives conversions, but because it deepens loyalty once customers are already in.

The feedback shows a clear shift in how customers interpret sustainability in 2026. It’s no longer viewed as a separate initiative or a marketing layer on top of the experience. Instead, it acts as a trust multiplier, reinforcing the decision to stay loyal after the first purchase.

There’s an important nuance here, though. Sustainability only works when it’s grounded in product reality. Customers consistently rewarded sustainable practices when the product itself met expectations. When it didn’t, green messaging backfired fast.

In other words:

- sustainability + strong product = credibility

- sustainability without substance leads to skepticism

Customers are far more informed than they used to be, and the feedback reflects that. Vague claims, generic eco-badges, or over-polished language trigger doubt rather than admiration. What actually earns positive sentiment are concrete, visible choices, the kinds of decisions customers can feel, not just read about.

Across responses, three signals showed up again and again:

- Transparent sourcing – where materials come from, and why those choices were made

- Minimal packaging – less waste, less overengineering

- Credible trade-offs – especially messaging like “this ships slower because it’s greener”

That last point is especially telling. Customers aren’t demanding perfection. They’re willing to accept compromises, even slower delivery, as long as the reasoning is clear and honest. Sustainability becomes part of the expectation-setting process, not an excuse buried in fine print.

This is why the role of sustainability in ecommerce CX has fundamentally changed. In 2026, it doesn’t magically convince people to buy. Instead, it strengthens the relationship after the purchase, reinforcing the feeling that sticking with a brand was the right call.

Sustainability isn’t a conversion lever, it’s a retention accelerant.

When done well, it quietly signals care, consistency, and long-term thinking, exactly the traits customers reward with loyalty.

Pricing & Value: The Only Net-Negative CX Pillar

If product quality is where loyalty is built, pricing & value is where it most often breaks. In this study, it’s the only CX pillar with net-negative sentiment, scoring 55.5% negative, and the emotional intensity behind those responses is impossible to ignore.

This is also where the findings become especially revealing. Customers didn’t leave angry feedback because something was “too expensive”. They reacted when prices stopped making sense in the context of the experience they received. That distinction matters more than ever in 2026.

Customers rarely complain about price. They complain about unjustified price.

When we looked closely at the negative responses, clear patterns emerged and none of them were about absolute cost. Instead, frustration clustered around moments where value felt misaligned or obscured:

- Sudden price changes between visits or at checkout, without explanation

- Shipping fees revealed late, turning what felt like a fair deal into a bait-and-switch

- Premium pricing without a premium experience, where expectations were raised but not met

These moments trigger distrust, not simply dissatisfaction. And once pricing feels deceptive or arbitrary, customers don’t argue – they disengage.

What makes this especially dangerous is how easy it is to misread the problem. Many brands respond to pricing backlash with discounts, promotions, or urgency tactics. That may temporarily reduce friction, but the data shows it doesn’t rebuild confidence. It just postpones the next disappointment.

In 2026, this approach is actively risky. Discounts mask value problems, but they don’t fix them. Over time, they train customers to expect compensation instead of clarity.

The brands that perform best in this category do something different. They invest in framing value, not racing to the bottom. They explain:

- why something costs more

- what customers get in return

- where trade-offs exist and why they’re worth it

This connects directly to trust. When customers understand the logic behind pricing, they’re far more tolerant even when prices rise.

Pricing doesn’t break loyalty, misaligned value does.

And in 2026, value is defined by how well the price matches the promise across the entire customer experience.

Shopping Experience: Friction Is a Silent Loyalty Killer

Shopping experience rarely shows up as the loudest complaint, and that’s exactly why it’s so dangerous. In the data, this pillar performs strongly (68.7% positive) when journeys are seamless, but it also plays a quiet, amplifying role across the entire CX. When it works, everything else feels better. When it doesn’t, loyalty erodes slowly and almost invisibly.

Customers are clear about what they reward here, and it’s more practical than flashy:

- Speed without confusion: fast pages that don’t sacrifice clarity

- Predictable checkout: no surprises, no mental gymnastics

- Mobile-first clarity: designed for thumbs, not desktops shrunk down

When these basics are in place, customers don’t gush about the experience; they simply move forward with confidence. And that’s the point. A good shopping experience doesn’t draw attention. It removes doubt.

What hurts sentiment, on the other hand, is rarely one big failure. It’s the accumulation of micro-frictions that signal something is off:

- forced logins at the wrong moment

- unnecessary redirects

- slow reloads or broken states

- repeated requests for the same information

Add to that personalization without relevance, and frustration compounds. Customers don’t mind recommendations, they mind bad ones. When personalization feels random, repetitive, or disconnected from intent, it feels careless.

One of the most important insights from the cross-pillar analysis is this: shopping experience amplifies everything else. A smooth journey makes premium pricing feel more justified, product quality more trustworthy, and sustainability choices more credible. A clunky one does the opposite.

But on its own, shopping experience rarely creates loyalty. Customers don’t become advocates because checkout was fine. They become advocates when the entire experience holds together and shopping experience is the connective tissue.

That’s why this pillar is often misunderstood. Brands look for dramatic drop-offs at checkout, while the real damage happens quietly, session after session, as friction accumulates.

CX doesn’t fail loudly at checkout, it leaks slowly.

Today, the brands that win are the ones obsessing over the small, unglamorous details before customers ever feel the need to complain.

Customer Service: Fast, Human, and Proactive Wins Every Time

Customer service is where ecommerce CX is either redeemed or exposed. In the data, this pillar performs strongly (70.8% positive) when support feels fast, human, and in control, and collapses just as quickly when it doesn’t.

The pattern is consistent across brands and channels. There’s a clear correlation between three factors and a customer’s likelihood to become an advocate:

- Response speed: not instant, but timely enough to reduce anxiety

- Human tone: language that sounds like a person, not a policy

- Ownership: someone clearly responsible for moving the issue forward

When these elements align, even negative situations turn into positive memories. Customers don’t just forgive mistakes, they reward how those mistakes are handled.

Where sentiment drops is equally clear. The most negative responses aren’t about slow support alone; they’re about feeling trapped in the system. Three patterns show up repeatedly:

- Over-automation, where bots deflect instead of helping

- Unclear escalation paths, leaving customers unsure if anyone is actually in charge

- Repeating the same issue across channels, retelling the story with no visible progress

This is where many CX strategies quietly fail. Automation is introduced to scale support, but without accountability, it creates distance instead of efficiency. Customers don’t mind AI, but being ignored by it.

That distinction matters in 2026. AI-powered support is now table stakes. Customers expect chatbots, auto-replies, and suggested answers. What they don’t accept is unaccountable AI, systems that can respond, but can’t decide, resolve, or hand off responsibility.

The strongest-performing brands make one thing obvious: there is always a human behind the system. Even when AI is involved, the experience signals control, care, and continuity.

And that’s the real insight from the data:

Customers don’t want perfect answers. They want responsible ones.

Responsibility – not speed alone, not scripts, not automation – is what turns customer service into a loyalty engine instead of a liability.

Shipping & Delivery: The CX Battleground

If there’s one place where ecommerce CX is truly decided, it’s shipping and delivery. In the data, this pillar is the most volatile of all, capable of creating both strong Promoters and vocal Detractors, often for the same brand. In the data, it is almost evenly split – 47.8% positive versus 41.4% negative. That volatility is exactly what makes it a battleground.

By the time customers reach this stage, most of the work is already done. They’ve chosen the product, accepted the price, and trusted the brand enough to place an order. Shipping and delivery are where that trust is either reinforced or undone.

This is also why this pillar carries so much emotional weight. Shipping and delivery shape the final memory of the experience. And in CX, the ending matters more than the middle.

The data shows two very clear outcomes:

- Handled well → trust multiplier: Customers feel reassured, in control, and more willing to buy again even if things weren’t perfect.

- Handled poorly → brand rejection: Delays, silence, or friction signal that the brand disappears when things get inconvenient.

What separates top-performing brands here isn’t speed alone. It’s how well they manage expectations and uncertainty. The strongest patterns in positive feedback point to three consistent behaviors:

- Proactive updates that explain what’s happening before customers feel the need to ask

- Clear expectations set upfront, especially around timing, costs, and return conditions

- Easy reversibility, where returns feel like a safety net rather than a punishment

Customers don’t expect logistics to be flawless. They expect them to be fair, transparent, and recoverable. When returning an item is simple and respectful, it lowers the perceived risk of buying in the first place, which quietly boosts conversion and repeat purchases.

This is why shipping and delivery can’t be treated as operational afterthoughts in 2026. They’re part of the brand experience, just as much as product or pricing.

Shipping isn’t logistics, it’s a promise.

And the brands that keep that promise consistently are the ones customers come back to even when something goes wrong.

The Six-Pillar CX Model for 2026 (Derived, Not Invented)

By this point, one thing should be clear: this isn’t a framework invented in a workshop or borrowed from a consulting slide. It’s derived directly from customer behavior, repeated at scale, across real ecommerce journeys.

We did not start with a theory of what “should” matter. We started with what customers consistently talked about, then grouped those topics into the smallest set of categories that stayed stable across brands, verticals, and regions.

When we map sentiment intensity and topic patterns against Promoter behavior and repeat intent a very practical CX model emerges that shows where loyalty is built, supported, corrected, or lost.

Here’s how the six pillars stack up in 2026:

| CX Pillar | Positive | Loyalty Impact |

| Product & Quality | 80.6% | Highest – Winner |

| Sustainability | 97.2% | Rising Star |

| Pricing & Value | 39.5% | Negative – Pain Point |

| Shopping Experience | 68.7% | Supportive |

| Customer Service | 70.8% | Corrective |

| Shipping & Delivery | 47.8% | Decisive – Battleground |

What this table makes visible is something many CX programs miss: not all pillars play the same role.

The data reveals a useful hierarchy: some pillars are stable loyalty foundations (Product & Quality), some are amplification layers (Shopping Experience, Sustainability), some are corrective (Customer Service), and two are structurally high-risk because they swing sentiment hard (Pricing & Value, Shipping & Delivery).

Namely:

- Product & quality accounts for the largest share of positive sentiment, building loyalty at the core.

- Sustainability strengthens it over time. While lower in volume, data show universal positivity when it appears.

- Pricing & value is the only pillar with persistent negative sentiment and can undermine everything if misaligned.

- Shopping experience quietly supports or weakens the whole system, by shaping perceived effort and confidence.

- Customer service repairs damage when things go wrong; it basically determines whether failures become scars or stories of recovery.

- Shipping & delivery decide how the story ends.

This is why the same six pillars can apply broadly, while still producing different “Monday priorities” depending on your customer mix, vertical, and geography.

Most importantly, no pillar operates alone. Customers don’t evaluate CX in silos. They experience it as a single, connected system. A strong product makes slower shipping tolerable. Clear pricing makes friction feel fair. Good support can recover a broken delivery but only once.

This is why chasing excellence in one area rarely works. A beautiful checkout can’t rescue weak value. Sustainability messaging can’t compensate for poor quality. Fast support can’t undo repeated surprises.

Loyalty doesn’t come from isolated wins. It emerges from alignment when all six pillars tell the same story. That alignment is what separates brands that merely function from brands customers actually stick with.

From Pillars to Moments: Where CX Is Actually Felt

The six CX pillars explain where loyalty is built or broken. But customers don’t experience pillars, they experience moments. They remember what arrived in the box, how delays were communicated, whether support felt human, and whether the price still made sense at the end.

When we broke down the feedback inside each pillar, a clear pattern emerged. Positive sentiment clustered around a small set of repeatable moments that made customers feel confident, respected, and in control. Negative sentiment, meanwhile, concentrated around moments that created surprise, friction, or a sense of unfairness.

The infographic below translates those patterns into concrete behaviors. On the left are the moments customers consistently reward with trust and repeat intent. On the right are the moments they punish, often quietly, by disengaging, complaining, or not coming back.

This isn’t a list of best practices. It’s a map of where customer experience becomes emotional, and where small execution gaps create outsized damage.

Tip: To translate topic-level sentiment into actionable insight, we consolidated overlapping and closely related feedback themes into concrete experience moments, reflecting how customers actually perceive and react to CX, rather than how topics are labeled in the underlying data.

Top Positive Drivers

- Product quality exceeding expectations

- Sustainable packaging / refills

- Fast, human customer support

- Clear communication during delays

- Accurate product descriptions & fit

Top Negative Drivers

- Prices feeling unjustified

- Hidden or late shipping fees

- Delivery delays without updates

- Complicated returns / refunds

- Checkout friction or forced logins

Segmentation check: does this apply to me?

First-time vs repeat buyers showed meaningfully different friction patterns.

Repeat responders scored +0.31 higher on average. First-time buyers were more price-sensitive (61% negative on pricing vs 45% for repeat). Repeat buyers were more critical of shipping (46% negative vs 37% for first-time) and rated service higher (~85% vs ~75% positive).

What this suggests operationally:

- First-time buyers are running a “trust evaluation.” Their feedback concentrates around value clarity and early-stage reassurance (pricing fairness, communication clarity, expectation setting).

- Repeat buyers are running a “consistency audit”. They already decided you’re worth trying, now they judge whether you’re reliable at scale (shipping reliability, service quality, subscription flexibility).

- That means friction doesn’t disappear with loyalty, it shifts. Repeat customers often become less forgiving of operational slippage, especially shipping, because they have a baseline from past orders.

Takeaway: Win first-time buyers with value clarity and communication; retain repeat buyers with operational reliability (shipping) and support consistency. If you’re seeing churn among repeat buyers, look first at consistency failures (delivery, subscription controls, policy friction), not acquisition messaging.

Vertical lens

Pain points varied by category. Personal care skewed toward product malfunctions and subscription friction. Apparel surfaced fraud-prevention blocks as a leading issue, alongside delivery and returns. Home goods concentrated around quality-price mismatch. Food & beverage was dominated by pricing. Subscription boxes surfaced technical bugs and website UX friction.

What this changes about “the six pillars”:

- The pillars stay stable, but the highest-risk failure mode inside each pillar changes by vertical.

- In functional categories (personal care devices, subscriptions), product reliability and subscription controls become disproportionate drivers of negative sentiment.

- In apparel, trust and verification systems (fraud prevention blocks, cancellations) can create friction before the customer even receives a product, meaning “shopping experience” becomes a trust gate, not just a UX issue.

- In home goods, the core tension is often value justification: high-ticket products raise expectations, so “pricing” negativity frequently reflects quality-to-price mismatch rather than price alone.

- In food & beverage, pricing dominates because customers compare to retail baselines and substitutes. Premium positioning must be constantly justified through quality, convenience, or differentiation.

- In subscription boxes, operational and technical reliability becomes central because customers must manage accounts, skips, and delivery cycles; platform friction behaves like churn fuel.

Takeaway: The six pillars hold, but the “battleground” within each pillar shifts by vertical. So the model is portable, but the priority order must be vertical-aware.

Regional lens

Shipping sentiment differed sharply by region in this dataset. To single out a few: UK ~70% shipping satisfaction; North America ~30%; France ~44%, with pricing and expectations also prominent.

What this suggests:

- “Shipping performance” isn’t a universal constant. The same brand-level execution can land differently depending on carrier reliability, distance, customs, and local expectations.

- In lower-satisfaction regions, shipping feedback often clusters around delays + loss anxiety + low transparency, which increases the emotional intensity of complaints even when the product is liked.

- In regions where shipping satisfaction is higher (for example, UK in this dataset), the “shipping pillar” may move from battleground to baseline and attention shifts more toward pricing narrative and value clarity.

- France showing “expectations” alongside pricing suggests a specific failure mode: promise-reality mismatch (marketing claims vs what arrived, delivery expectations vs actual experience).

Takeaway: Shipping performance is not a universal baseline; local reliability and expectation-setting can change the same pillar’s risk profile. If you operate across regions, you should treat shipping as a region-specific risk model, not a single global KPI.

Cross-cutting trust and policy friction

Some pain points span multiple pillars and are best understood as “trust and policy fairness” issues: fraud-prevention blocks (order cancellations/payment verification), subscription management (skip/pause/cancel friction or unwanted renewals), and policy disputes (returns/warranty terms). These show up inside the six pillars, but they behave like a distinct class of churn triggers and often warrant dedicated ownership.

Why this matters:

- These issues often produce high-negative sentiment with low tolerance, because customers interpret them as fairness failures, not normal friction.

- They also create a “trapped” feeling (blocked orders, unclear cancellation, disputed policies), which tends to escalate from dissatisfaction into loss of trust.

- Operationally, they rarely live in one team: fraud rules might sit with risk/payments, subscription flows with product, policies with ops/legal, and escalation with support, which is why they often persist even in otherwise strong CX programs.

Treat trust/policy friction as a cross-functional risk lane with an explicit owner. Even though these topics are captured within the six pillars, they behave like “deal-breakers,” especially in apparel (fraud blocks) and subscription-heavy models (management friction).

What This Study Changes About Ecommerce CX Strategy

The biggest shift this study demands isn’t a new tool, a new metric, or a new playbook. It’s a change in how CX is understood inside the business.

Too many ecommerce teams still treat CX as something you measure after the fact. It shows up as:

- surveys sent at the end of a journey

- dashboards reviewed once a month

- isolated teams owning “their” part of the experience

That approach explains why so many brands feel blindsided when loyalty drops. By the time the numbers move, the damage is already done.

The data points in a different direction. In high-performing brands, CX behaves less like a report and more like infrastructure, something that’s always on, always connected, and always informing decisions.

In 2026, the most effective teams treat CX as:

- an operating system, not a scorecard

- continuously monitored across all six pillars

- shared across product, operations, support, and marketing

This doesn’t mean more surveys or more charts. It means knowing where friction is starting to form before it shows up as churn. It means connecting feedback to behavior, sentiment to action, and issues to owners.

The real competitive edge isn’t having a high NPS average on a slide, but detecting loyalty leakage early spotting when value perception slips, when shipping anxiety increases, or when support effort quietly rises and fixing it while customers are still willing to stay.

Loyalty Is Built Where CX Feels Honest

After analyzing customer voices across dozens of ecommerce brands, the conclusion is surprisingly simple and impossible to ignore.

Customers aren’t asking for perfection. They’re not demanding frictionless everything, instant delivery, or endless discounts. What they consistently reward is something far more grounded: honesty.

Loyalty grows where experiences feel:

- truthful: products match the promise, pricing makes sense, sustainability claims hold up

- predictable: expectations are set clearly and met consistently

- worth the price: value is explained, not disguised

And loyalty collapses where the opposite happens:

- brands overpromise and underdeliver

- friction is hidden instead of explained

- value is confused with discounts rather than earned

Across every pillar in this study the same pattern repeats. Customers stay loyal when the experience feels coherent and fair, even when things aren’t perfect. They leave when it feels evasive, inconsistent, or disconnected.

That’s the real lesson for ecommerce CX in 2026. Competitive advantage won’t come from being the fastest, the cheapest, or the most automated. It will come from building experiences that customers can trust, even under pressure.

Want to see how your customers rate your experience across these six pillars? Learn more about Retently’s ecommerce CX solution in a demo call or by starting a free trial.

Christina Sol

Christina Sol

Greg Raileanu

Greg Raileanu